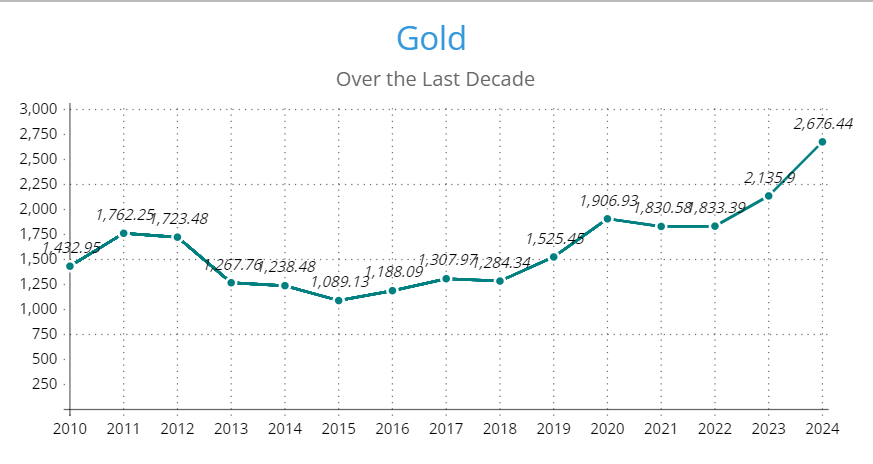

Gold’s Resilience Amidst Financial Upheaval

Gold has always represented wealth, an indispensable commodity that has come out of the ravages of time. Gold over the last decade, more than ever, demonstrated how invaluable it is as the storm of moving and changing, financial upheaval, economic crises, and global uncertainties brew. For example, in 2011, gold reached a record high of $1,917.90 per ounce, driven by economic instability and debt crises. As with some of the other assets, gold is on an upward trajectory, and it has even gone above the water level of disturbance. By 2020, during the COVID-19 pandemic, gold hit another peak of $2,067.16 per ounce, reflecting its role as a haven asset. These data points highlight gold’s consistent growth amidst turmoil.

The Geography Business Pattern and Its Result on Gold

The past decade has seen its share of shocks in the economic sphere – starting from financial crises and ending with lockdowns and trade wars. Such periods create a raise in gold demand, with 2013 being a notable year when global gold demand exceeded 4,000 metric tons, spurred by economic uncertainty in emerging markets. These days, it is the most important during global crises. For instance, in 2019, the US-China trade war contributed to gold prices rising by over 18% within the year, as many unknowns about global trade emerged. Gold serves as an armor during fluctuations, which is a concept that worked especially well when standard forms of investment crashed, as seen in 2020 when its demand soared during the pandemic-induced recession.

Its Function When There Is Economic Uncertainty

Stock market swings involving global operations of the economy in the last decade also describes gold’s state. For instance, following the Eurozone debt crisis in the years 2010-2012 the increase in the prices of gold was close to 30%, proving that the metal had demand in unsteady financial environment. Likewise, when Brexit hit its heights in 2016, so too did gold prices, mainly because people wanted insurance against the uncertain currency markets. The year 2020 was yet another testimony to the durability or gold when the annual returns crossed 24 percent due to the COVID-19 outbreak. Such periods reveal that they have always provided a golden ground to act as a barrier to inflation and currency devaluation. This is because while the national monies get disturbed, gold safely bails value and purchasing power.

How Gold Has Performed as Compared to the Stock Market

As can be seen from the above example, the performance of gold to that of the stock market in particular is quite distinct. The S&P 500 index from 2011 to 2021 provided an average of about 13.6% an annual return but was erratic and even fell by 34% in the year the COVID-19 market crash occurred in 2020. On the other hand, while gold gave an average annual return of 6.3% in the same period, it was also a more stable investment. For example, the stock market was on the rise in 2013, and gold prices dropped by 28% further stressing on this reality. However, in year 2020 when the stock market went down in the initial period of the year gold rates touched new higher level which is another concrete evidence of its effectiveness in volatile economic conditions.

Effects of Inflation on Gold

Inflation remains as the key driver in determining the price of gold in the last one decade. For instance, in the calendar year 2011-2013, because of inflationary pressures, the price of gold hit the roofs due to the expansionary fiscal policies of the central banks. With inflation rates being many years high in such economies as America in early 2021, gold prices increased by 14% in the first half of the year. There was a strong positive relationship between inflation and gold in 2022 as persisting global inflation practices continued to fuel demand for the desks among investors. The role of gold has been the same for many generations – it effectively hedges against inflation protecting the purchasing power of the owner during inflationary circumstances.

The Monetary Metal as an Asset Class for Refuge During Political Turmoil

Political instability has been another driver of gold’s rise over the last decade. In 2017, during heightened tensions between the US and North Korea, gold prices increased by 13% as investors sought refuge from geopolitical risks. Similarly, in 2019, political uncertainties in the Middle East, including the US-Iran conflict, pushed gold prices to $1,500 per ounce, their highest level in six years. These examples demonstrate that gold’s untethered nature to political events makes it a reliable asset during various political incidences.

Technological Innovation as a Factor That Shapes the Gold Market

Technology has impacted the gold market significantly. New in 2015, digital trading platforms for gold led to a trading volume that was twenty percent higher than in 2014. By the end of the year 2020, new things such as the trade in gold using blockchain and the fractional investment applications helped investors access the gold market. These technologies made it easy for people to invest in gold as there was an expansion of 35% digital gold purchase in last year as comparing to the previous year. Thus, the emerging changes in market capabilities have affected the market, acting as a catalyst for the creation of a favorable environment for different classes of participants in securities market.

A Glimpse into the Future: The Prospects of Gold

Looking ahead, gold is poised to retain its critical position in international finance. In 2023, central banks purchased a record 1,136 tons of gold, reflecting their confidence in its long-term value. This trend suggests strong demand for gold as a hedge against inflation, market risks, and political instability. Projections indicate that gold prices could continue their upward trajectory, driven by ongoing economic fluctuations, geopolitical tensions, and the persistent effects of climate change.

Conclusion: Gold’s Timeless Allure

In the last decade, people realized that gold does not only represent luxurious material but also a commodity that protects wealth, brings stability, and provides security. Data from 2011 to 2021 consistently highlights its ability to weather economic storms and political uncertainties. Today, after many years of political unrest and an uncertain global economy, gold remains at the forefront as an eternal asset. As we look forward, its value projections are set to rise, making it a cornerstone for investment portfolios in the years to come.